Sales Tax Transaction Report

A Sales Tax Transaction Report is a comprehensive document that dives deep into the specifics of each sales transaction involving sales tax. It offers a granular view of each transaction as compared to Sales Tax summary reports, providing valuable insights of financials in many jurisdictions between businesses and customers. These transactions represent the collection and remittance of taxes on goods and services sold.

sBizzl offers a quick glance through your sales tax activity at the transaction level. It amplifies you to maintain accurate records of transactions, ensure proper tax collection and make informed tax-related decisions. Gain insights into sales tax collected by tax agencies, associated components (categories) or any tax authorities. This can be valuable for tax planning, error detection and optimizing tax compliance strategies.

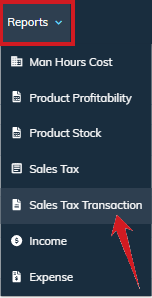

To access Sales Tax Transaction Report, follow steps:

- Navigate to the “Reports” menu.

- Select “Sales Tax Transaction” from the drop-down menu.

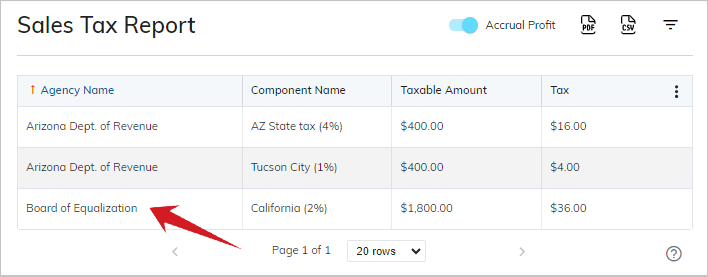

Or even you can navigate to the sales tax transaction report directly from the sales tax report summary.

- Reports > Sales Tax Report > Click on the specific record.

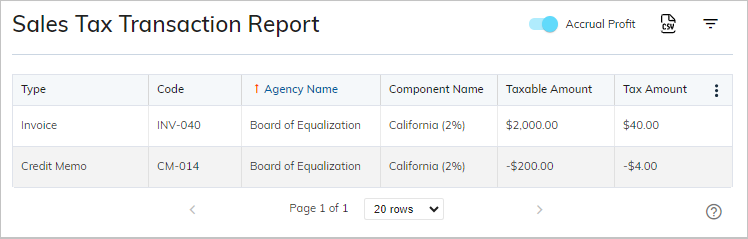

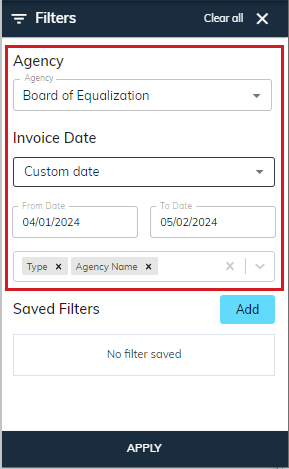

It will open “Sales Tax Transaction Report” as shown below. In this report, the filters are pre-selected that we had applied in the Sales Tax Report.

- As you can see in the below filters, the agency and custom dates are auto-selected, because it is redirected from the sales tax report.

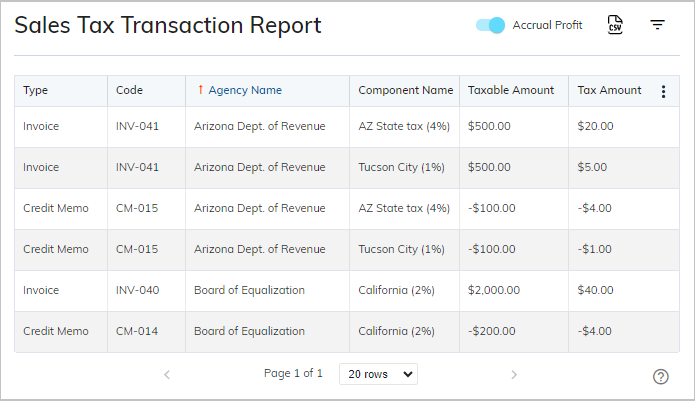

The sales tax transaction report contains a detailed look of the invoices (except draft) or credits and those on which taxes are applied. In short, it includes the transactions with applied taxes such as credits and invoices (exclude draft invoices).

Here’s a breakdown of what a sales tax report typically includes:

- Type: This identifies the type of the transaction either invoices or credits memos. Invoices represent sales where tax is collected, while credit memos indicate returns or refunds, potentially impacting the taxable amount and tax collected.

- Code: A unique code or identifier for transactions according to the types of transactions, facilitates easy reference and tracking. It can be invoice code or credit memo code.

- Agency Name: This column refers to the specific tax agency you're reporting to, such as your state’s Department of Revenue or a local tax authority. For example, it could be the Arizona Department of Revenue, Board of Equalization, etc. It’s beneficial if you operate in multiple jurisdictions with different tax agencies responsible for collecting sales tax.

- Component Name: This column refers to the specific category (component) or type of the tax along with the tax percentages. For example, it could be “State Sales Tax (5%)”, “Local Sales Tax (2%)” or a specific tax rate applied to certain goods or services. It denotes the specific sales tax rate applied to the transaction.

- Taxable Amount: The total amount on which sales tax is calculated for each transaction.

- Tax Amount: This column represents the amount of sales tax collected for each item, calculated by multiplying the taxable amount by the applicable tax rate.

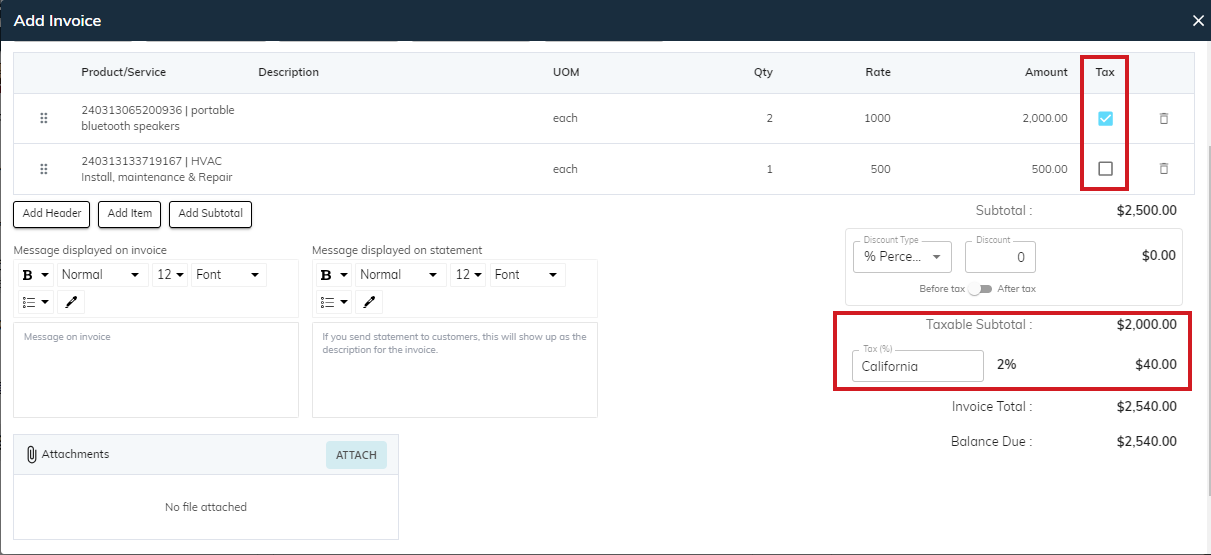

Here, sBizzl provides a new capability to decide whether to apply taxes or not on the list of items contained with products or services at the time of invoice creation.

- For example, a sales tax of 2% is applied and an invoice of a total amount of $2500, but out of which $2000 is taxable only. So, the taxes are applied on that $2000 only while the system would not consider the remaining $500. Therefore, $2000 is the taxable amount. And the sales tax amount would be $40.

Advanced Filters:

Accrual Profit:

Look at the “Accrual Profit” switch, which refers to the capability to toggle between cash-based and accrual based accounting methods for assessing profitability. By default, it is off which displays cash transactions. Turn it on to analyze accrual profits.

- Cash based accounting records revenue when money is received and expenses when money is paid out. It is based on the cash received from the customer.

- Accrual based accounting records revenue when it is earned and expenses when they are incurred.

- This integration offers businesses a wide flexibility to track and manage sales tax reports that better suits their needs.

Export to CSV:

You can export a CSV file of all the sales tax transaction summary at one click, based on the applied filters. Click on the “CSV” icon on the top right corner just before the filter icon.

The CSV export will contain the following information:

- Type

- Code

- Agency Name

- Component Name

- Taxable Amount

- Tax Amount

Filters:

This versatile tool allows you to play with your sales tax transaction data according to the specific criteria you define with its filtering and grouping options, which enhances overall productivity.

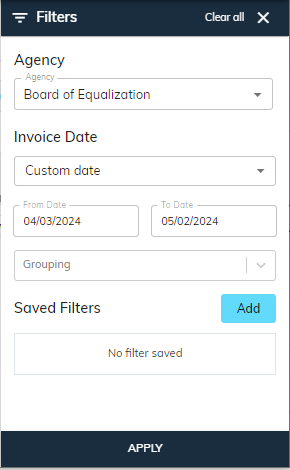

To apply various filters, click on the “filter” icon, it will open filter panel shown below:

- Agency: Incorporating agency searchable dropdown in filter, can significantly improve usability and efficiency. By default, the report might display data for all agencies. Users can search and select a specific tax agency from the dropdown ▼, to view its associated transactions.

- Invoice Date: You can find specific invoices on which sales tax are applied, by selecting various options listed below:

- This Month: By default, this option is selected, allowing you to evaluate and scrutinize report data within the current month.

- Last Month: This option allows you to analyze last month data.

- Custom Date: You can even specify custom dates by choosing this option, according to your analytical requirements. Select the from date and to date from the calendar 📅. You can make sales tax transaction reports more informative and efficient for anyone who needs to analyze or work with the data.

Grouping:

It offers a user-friendly interface and includes intuitive controls to expand or collapse grouped sections. It allows you to group or categorize your sales tax transactions based on the Transaction Type and Agency.

Sorting:

Sorting functionality provides a powerful tool for organizing, analyzing and accessing sales tax transactions, fostering quick and efficient sales performance. It allows you to sort report data by various criteria, often through clickable headers. The list allows you to easily apply sorting on Type, Codes, Agency Name, Component Name and Taxable Amount.

- Learn more about how to use advanced filters, sorting, grouping and column management.

Refer to the “Sales Tax Liability Report” for overall insights of taxes.