Income Report

An Income Report is a financial document that summarizes the revenue earned by a business or individual over a specific period. This report typically includes details such as sales revenue from goods or services and any other sources of income. It provides an overview of the financial performance of the entity, showing the total income generated and often broken down by category or source. Income Reports are essential for assessing a business's financial health and profitability, aiding in budgeting, forecasting, and decision-making processes.

- Navigate to Reports > Income.

- Search: sBizzl offers a powerful search feature that allows users to find data quickly and easily by searching using criteria such as customer, memo, payment method, or reference number.

- CSV: A CSV (Comma-Separated Values) file is a useful tool in sBizzl, enabling users to download data in a structured format. Users can export all the data displayed in a list when utilizing this feature.

- Filters: sBizzl empowers you to tailor your data view to your specific needs with its versatile filtering and grouping options:

- Customer: Filtering by customer allows users to narrow down data and focus specifically on records associated with a particular customer. By selecting this filter option, users can easily retrieve relevant information related to a specific customer.

- Payment Date: Filter by payment date feature offers users convenient options to narrow down data based on specific timeframes, enhancing data analysis and retrieval. Users can easily select from predefined options like the last 30 days, this month, this year, last month, and last year, or opt for a custom date range for more tailored results. This functionality streamlines data management tasks, enabling users to efficiently track and analyze payment information according to their business needs.

- Grouping: The grouping feature allows users to organize data effectively by grouping transactions, orders, or records based on customer, status, and payment method. This functionality streamlines data visualization and analysis, enabling users to quickly identify patterns, trends, and insights related to customer behavior, transaction statuses, and payment methods.

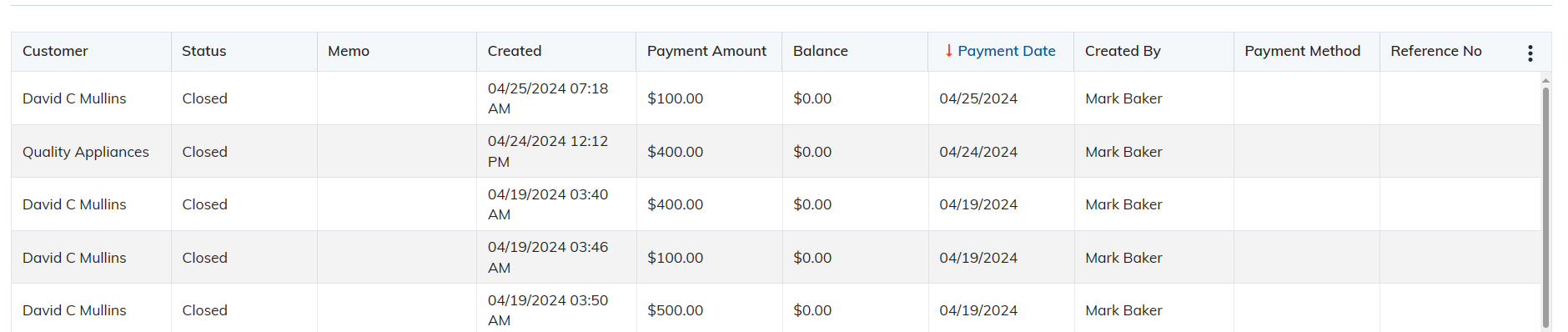

- Customer: The customer name column offers a sorting facility, allowing users to easily organize and view income data by customer names in ascending or descending order. This feature simplifies data analysis, enabling users to quickly identify key customers, track revenue trends, and prioritize follow-up actions based on customer transactions.

- Status: The status column provides a sorting feature, allowing users to arrange income data based on various statuses such as closed, partial, or unapplied payments. This functionality facilitates efficient organization and analysis of payment statuses, enabling users to quickly identify and manage transactions based on their current status. Whether tracking completed payments or monitoring outstanding balances, users can easily navigate and prioritize actions within the income report.

- Memo: The memo column offers a sorting feature, enabling users to arrange income data based on notes or memos added during payment transactions. This functionality streamlines data organization, allowing users to easily group and review payments based on specific notes or comments provided during the payment process.

- Created: The created date in the income indicates the date when the payment was initially created.

- Payment Amount: The payment amount column provides a sorting feature, allowing users to arrange income data based on the amounts paid by customers. This functionality facilitates efficient organization and analysis of payment data, enabling users to easily identify transactions based on their payment amounts.

- Balance: The balance column features a sorting capability, enabling users to arrange income data based on the pending balances resulting from payments made. This functionality enhances data organization, allowing users to prioritize follow-up actions and efficiently manage outstanding balances. Whether tracking overdue payments, identifying accounts with remaining balances, or reconciling financial records, users can leverage the balance sorting feature to streamline their payment management processes within the income report.

- Payment Date: The payment date column offers a sorting feature, allowing users to arrange income data based on the dates when payments were made. This functionality facilitates efficient organization and analysis of payment records, enabling users to easily track payment timelines and identify trends in payment activity over time.

- Created By: The Created by column features a sorting capability, enabling users to organize income data based on the individuals who manually entered payment entries. This functionality provides transparency and accountability by displaying the names of users responsible for creating payment entries, facilitating efficient tracking of data entry activities within the system

- Payment Method: The Payment method column offers a sorting feature, allowing users to arrange income data based on the mode through which payments were made. This functionality provides clarity on the payment methods utilized, displaying the method selected during manual payment entry and specifying "Square payment" when customers use credit cards or ACH via Square for transactions, enhancing transparency in financial tracking and reporting.

- Reference Number: The reference number column in the payment system displays either the manually entered reference number for manual payments or the Square payment ACH or credit card reference number for transactions initiated by customers. This setup ensures accurate tracking and organization of payment records, facilitating efficient reconciliation processes for businesses.