Customer Transaction Statement

A customer transaction statement, also known as an account statement or invoice summary, is a document that outlines the financial transactions between a business and a customer over a specific period of time. It serves as a record or summary of invoices, credit memos issued, payments received and any outstanding balances.

Statements provide a clear and verifiable record of customer transactions, facilitating accurate accounting and financial reconciliation. It becomes helpful to keep customers informed about their invoices, payments made, issued refunds and any other outstanding balances. This promotes transparency and seamlessly avoids billing disputes. It is easier to view all invoices sent and payments received at one place for a specific customer. Further, it can be used as a tool for payment reminders as it gives the businesses an idea about the customer’s recurring expenses. In that case, the business owner can send emails for payments in advance.

Create and send transaction statement to the customer:

- Navigate to CRM > Customers, then go to the customer details screen.

- Click on the Add > Statement button which is located on the top right corner.

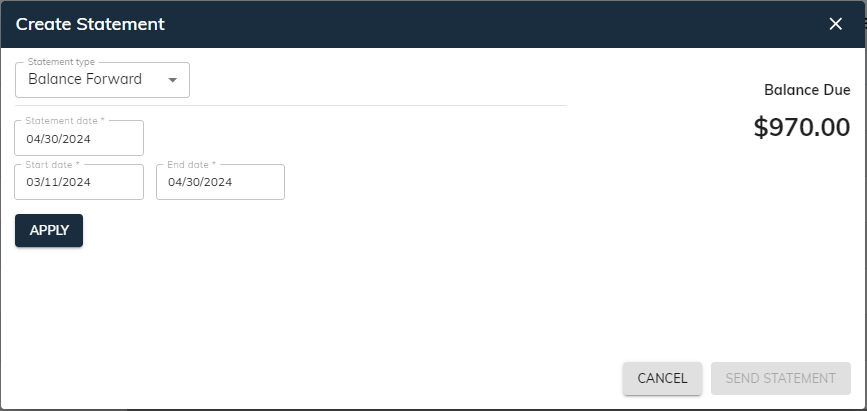

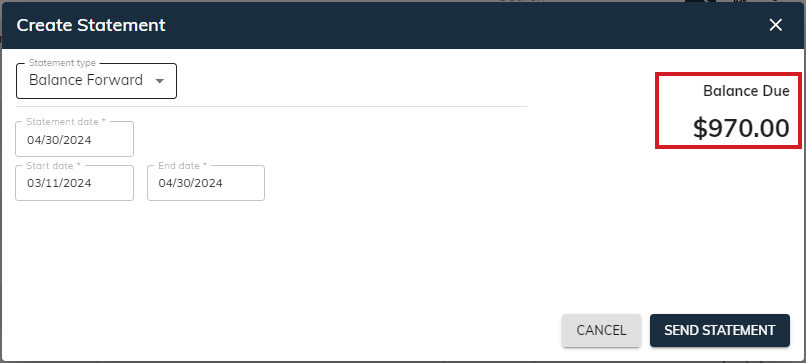

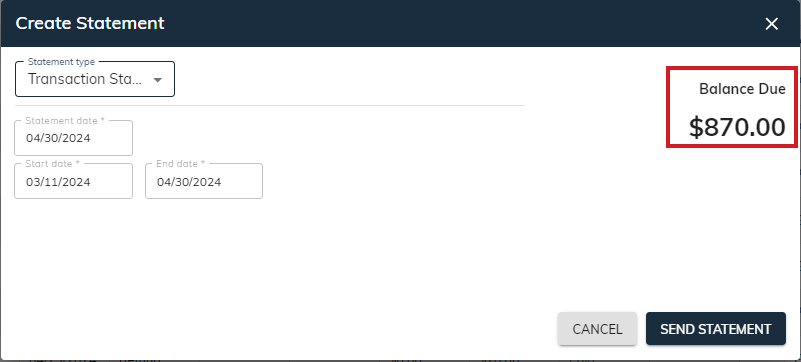

- It will open Create Statement modal as appear below:

Statements information typically includes:

- Statement type: This specifies the type of the statement that you want to generate. sBizzl can create three types of statements: Balance Forward, Open Item and Transaction Statement.

Balance Forward: A balance forward statement shows all activity dated between start and end dates you choose. In PDF, it has a Balance Forward amount at the top and keeps a running balance in the Balance column.

- Open Item: An open item statement shows all invoices, payments and credits that have an open balance. The original amount of each transaction is shown along with the open amount.

- Transaction Statement: Like a balance forward statement, a transaction statement lists all the transactions for the selected date range you choose. But it doesn't have a balance forward amount and amount due; it shows a total amount and amount received instead.

- Statement date: This is the date of the statement that you want to make the statement for. Select a specific date from the calendar 📅.

- Start date and End date: This specifies the time period covered by the statement. You need to select specific date ranges from the calendar 📅, if the statement types are Balance Forward or Transaction Statement.

Balance Due: It refers to the outstanding balance that has not been paid off yet by the customer. This mainly depends on the time period you choose and type of statement you generate.

- Apply button: If you make changes in the statement type or start date and end date ranges, then click on the “Apply” button to view updated balance dues.

- Additionally, the system will also keep checks if there are any transactions or not within selected date ranges. Meanwhile it displays “No statements” messages and disables the “Send Statement” button as shown below. You need to select the time frame which has any transaction with the customer.

Statement types:

The various statement types described in detail. Here, we used transactions given below, for calculating balance dues and generating statements.

- This type of statement shows a running balance of a customer’s account throughout the specified statement period.

- In PDF, it includes lists of all invoices, payments, credit memos and refunds with outstanding balances for a specific date range.

Calculating balance due amount:

The balance due calculation involves invoices, payments, credits and refunds.

- Invoice open amount: All the invoices with status open and partial. Those invoices generated between the selected start date and end date. The invoice open amount can be found by subtracting the total invoice amount with the received amount against that invoice.

(Invoice open amount = Total amount - received amount) - Payment open amount: All the payments which are unapplied or partial and whose payment dates are between selected date ranges.

- Credit memo open amount: All the credits which are unapplied and issued between selected start date and end date. The credit memo open amount can be calculated by subtracting the total amount of credits issued with the applied credits balance and refunded amount.

(Credit memo open amount = Total credits balance - applied credits - refunds issued) - Refunded amount: All the refunds which are paid and whose refunds dates are between selected date ranges.

- Therefore, outstanding invoice balances can be computed by adding the sum of all invoice open amounts and sum of all refunded amounts. Total payments can be figured by addition of the sum of all payment open amounts and sum of all credit memo open amounts. And balance due can be determined by subtracting the outstanding invoice balances with total payments.

- Outstanding invoice balance = Sum of all invoice open amount + sum of all refunded amount.

- Total payments = Sum of all payment open amount + Sum of all credit memo open amount.

- Balance due = Outstanding invoice balance - Total payments

This way we can figure out the Balance due amount for Balance Forward.

Generate PDF:

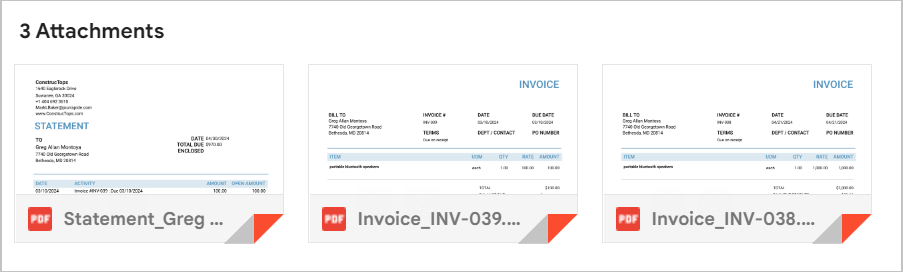

- Click on the “Send Statement” button, it will open the modal shown below.

- Users can define emails in TO, CC or BCC fields as well as enter subject or short description.

- If you want to send all the invoices that lies between current statement period, then select the ☑ Send Invoices As Attachments. Finally, click on the “Send” button, to send the transaction statement to the customer.

- Note: You can configure the email address of the customer directly from the customer details. For that, you need to edit customer details and add multiple emails, then configure it. Please refer to customer details (Configure email addresses to send invoices and estimates section), how to configure email addresses.

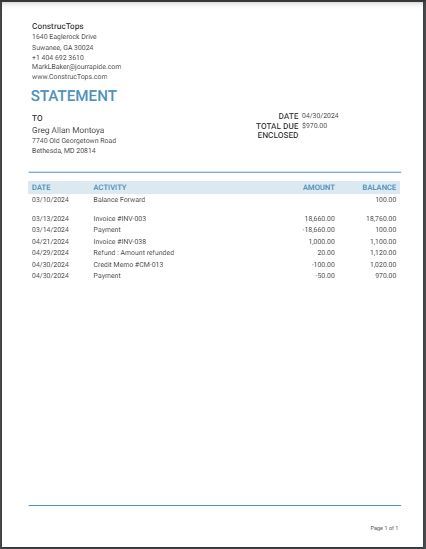

PDF view explanation:

A statement is typically divided into two halves. The top half contains an overview of the customer’s accounts. The bottom half contains the details of each transaction.

The top half of the statement contains-

- The name and address of both the business and the customer.

- Here in PDF, you can see the statement date as DATE. As the statement date is not used for any calculations. It specifies the date on which you created the statement for.

- Total due is the same as the Balance due in previous modal.

The bottom half contains the details of each transaction. The transactions information describes below:

- Date: The date on which invoice, payment, credits or refunds are generated.

- Activity: The activity column refers to the type of transaction such as Invoice, Payment, Credit Memo or Refund along with codes and brief description given in the memo field. It also includes the Balance Forward amount, which highlights the previous balance carried forward to the current statement.

- Balance Forward: It starts with a “Balance Forward” amount, which represents the outstanding balance from the previous statement period. It includes all transactions whose dates are less than start date (or a day before start date). It’s calculated by subtracting the sum of all unapplied payments from the sum of all outstanding invoice balances.

(Sum of all outstanding invoice balance - Sum of all payments)

It then lists all transactions that occurred during the current statement period, including their dates and amounts. Each transaction record has its total amount shown along with the running balance, which results in increase or decrease the balances (Balance column).

- Invoices: All invoices between start date and end date excluding drafts. By adding the balance of the previous transaction with the current transaction amount, it generates new Balances. (In short, invoice amount is added, which results in an increased balance.)

- Payments: All payments between selected date range. It doesn’t include payments with zero balances. It generates new Balances, by subtracting the current transaction amount from the previous transaction’s balance. (In short, the payment amount is subtracted, which results in a decreased balance.)

- Credit memos: All credits that lie between start date and end date. By subtracting the current transaction amount from the balance of the previous transaction, it generates new Balances. (In short, credit amounts are subtracted, which results in a decreased balance.)

- Refund list: All the issued refunds between selected start date and end date. It generates new Balances, from the addition of previous transaction’s balance and current transaction amount. (In short, refund amount added, balance increased.)

- Amount: The total amount of the transaction. In PDF, you can see the minus (-) sign in the Amount column for the payments and credit memos. (Payments and Credits are usually represented as a negative value because they reduce the customer’s outstanding balance.)

- Balance: It’s calculated by adding or subtracting previous transactions based on the type of transaction from the current transaction record.

Below given a sample PDF format for Balance Forward with explanation:

- We have selected date ranges from Mar 11, 2024 to Apr 30, 2024, for generating statements.

- As you can see in the above PDF, Balance forward has total 100 which is remaining balance till Mar 10, 2024.

- After that, invoice amount of 18,660, so it would be added with remaining Balance Forward of 100, which results in the new balance of 18760. Then, made payment of 18660, which is subtracted from 18760, so the new balance would be 100. Similarly, Invoice amount of 1000 is added with previous new balance 100, then the new balance will be 1100. Likewise, refund amount 20 is added with previous balance 1100, it would become 1120. Now, the credit balance of 100 is deducted from the previous balance 1120, so the new balance would be 1020. And lastly, a payment amount of 50 is deducted from the previous balance of 1020, the new remaining balance would be 970.

2. Open Items

- This type of statement focuses solely on the unpaid invoices, also known as open items.

- This format provides a clear picture of the specific transactions that remain outstanding. Effective for highlighting outstanding invoices and overdue payments. Moreover, it is beneficial for reminding customers to settle their accounts.

- In PDF, it includes lists of all outstanding invoices along with unapplied payments and credit memos based on the selected statement date.

Balance Due: It is the total outstanding balance, calculated based on the selected Statement date.

Calculating balance due amount:

The balance due calculation involves invoices, payments and credits.

- To get balance due and all open items for the PDF generation, we have used the selected Statement date.

- Invoice open amount: All the invoices with status open and partial. Those invoice generated dates are not greater than the statement date. The invoice open amount can be found by subtracting the total invoice amount with the received amount against that invoice.

(Invoice open amount = Total amount - received amount) - Payment open amount: All the payments which are unapplied or partial and whose payment dates do not exceed statement date.

- Credit memo open amount: All the credits which are unapplied and issued till selected statement date. The credit memo open amount can be calculated by subtracting the total amount of credits issued with the applied credits balance and refunded amount.

(Credit memo open amount = Total credits balance - applied credits - refunds issued) - Therefore, outstanding invoice balances can be the sum of all invoice open amounts while total payments can be figured by addition of the sum of all payment open amounts and sum of all credit memo open amounts. And balance due can be determined by subtracting the outstanding invoice balances with total payments.

- Outstanding invoice balance = Sum of all invoice open amount

- Total payments = Sum of all payment open amount + Sum of all credit memo open amount

- Balance due = Outstanding invoice balance - Total payments

Generate PDF

- Click on the “Send Statement” button, it will open the modal shown below.

- Define emails in TO, CC or BCC fields and enter subject or short description for sending the statement .

- Select the ☑ Send Invoices As Attachments, if you want to send all the invoices that till current statement period. By selecting this option it will send all the invoices along with the statement. This integration eliminates the need to find and attach the invoices manually, streamlines communication and improves operational efficiency.

- Then, click on the “Send” button, to send the statement to the customer.

- You can see below attachments in the email.

PDF view explaination:

- The top half of the statement contains the name and address of both the business and the customer. Here in PDF, you can see the statement date as DATE. Total due is the same as the Balance due in previous modal.

- The bottom half contains the details of each transaction, describes below:

- Date: The date on which invoice, payment or credits are generated.

- Activity: It refers to the type of transaction such as Invoice, Payment, or Credits with associated codes, due dates and brief description given in memo field. It lists all transactions that have an open balance, occurred during the current statement period. The original amount of each transaction is shown along with the open amount.

Here, all the invoices, payments and credits are considered based on the selected statement date (The date of the transactions is less than or equal to the statement date). It just shows the individual transaction records with their corresponding total amount and open amount.

- Invoices: All invoices which are open or partial.

- Payments: All payments that are unapplied or partial.

- Credit memos: All credits which are unapplied.

- Amount: The total amount of the transaction. In PDF, you can see the minus (-) sign in the Amount column for the payments and credit memos. (Payments and Credits are usually represented as a negative value because they reduce the customer’s outstanding balance.)

- Open Amount: It specifies the remaining amount of the transaction. In PDF, it displays the minus (-) sign in the Amount and Open Amount columns, as payments and credits deducts the unpaid balance.

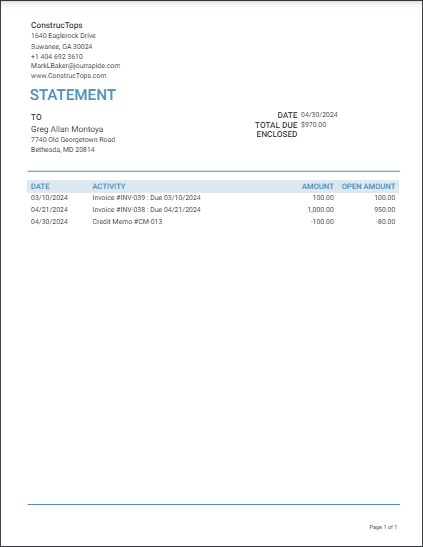

Below given a sample PDF format for Open Items with explanation:

- We have selected statement date Apr 30, 2024, for generating statements of type open items.

- As you can see in the above PDF, the amount column is the total amount of transactions while the open amount column is the remaining balance. Here, invoice is of total amount 100, out of which 100 is outstanding. Similarly, the second invoice has a total amount of 1000, out of which 950 is still outstanding or unpaid. It means, the received payment is 50 only. Likewise, the original total amount of credit memo is 100, out of which only 20 credits are utilized and 80 credits are still remaining.

3. Transaction Statement

- This type of statement offers a chronological list of all transactions (invoices and credits) that occurred during the specified statement period (between selected start date and end date). It mainly focuses on individual transactions without displaying a running (open) balance.

- In PDF, it includes lists of all invoices and credit memos with received balances for a specific date range you choose.

- Although, this type of statement doesn’t display balance forward or due amounts.

Balance Due: It is the total remaining or unpaid balance that the customer has yet to pay.

Calculating balance due amount:

The balance due calculation involves invoices, payments, credits and refunds.

- Invoice open amount: All the invoices with status open and partial. Those generated invoices are between selected start date and end date. It’s calculated by subtracting the received amount from the total invoice amount.

(Invoice open amount = Total amount - received amount) - Credit memo open amount: All the issued credits which are unapplied occurred during the specified statement period. It’s determined by subtracting the total amount of credits issued with the applied credits balance and refunded amount.

(Credit memo open amount = Total credits balance - applied credits - refunded amount) - Therefore, outstanding invoice balances are the sum of all invoice open amounts while total credits can be the sum of all credit memo open amounts. And balance due can be determined by subtracting the total credits from the outstanding invoice balances.

- Outstanding invoice balance = Sum of all invoice open amounts.

- Total payments = Sum of all credit memo open amount.

- Balance due = Outstanding invoice balance - Total credits

This way we can figure out the Balance due amount for Transaction Statement.

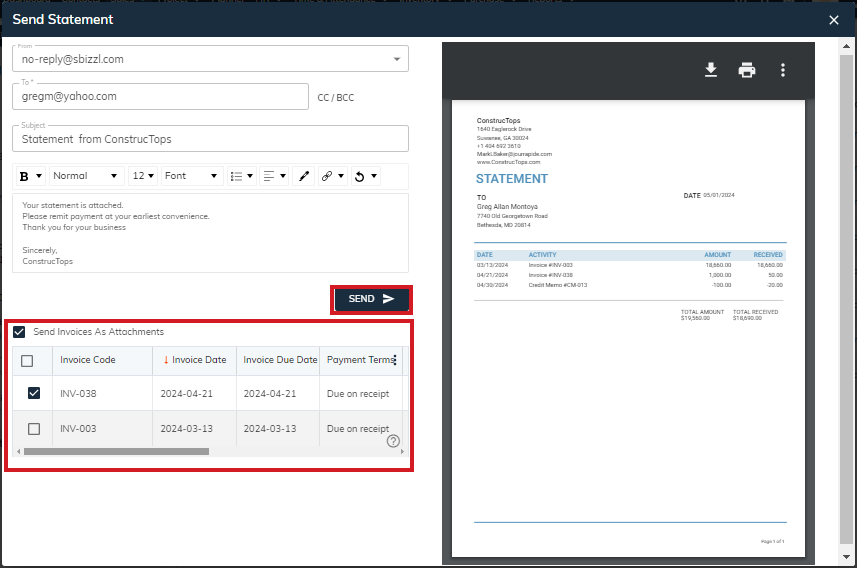

Generate PDF:

- Click on the “Send Statement” button, it will open the modal shown below.

- Define emails in TO, CC or BCC fields as well as enter subject or short description.

- If you want to send all the invoices that lies between current statement period, then select the ☑ Send Invoices As Attachments.

- Finally, click on the “Send” button, to send the transaction statement to the customer.

PDF view explaination:

The top half of the statement contains the name and address of both the business and the customer. Here in PDF, you can see the statement date as DATE. As the statement date is not used for any calculations. It specifies the date on which you created the statement for.

- The bottom half contains the details of each transaction, describes below:

- Date: The date on which invoices are generated or credits are issued.

- Activity: It refers to the type of transaction such as Invoice or Credit Memo along with codes and brief description given in the memo field. Like Balance Forward Statement, it doesn’t include the Balance Forward amount or due amounts.

It lists all transactions that occurred during the current statement period, including their dates and amounts. Each transaction record has its total amount shown along with the received amounts. - Invoices: All invoices between start date and end date except drafts.

- Credit memos: All credits that lie between start date and end date.

- Amount: The total amount of the transaction.

- Received: It is the total receivable amount out of the total amount of the transaction.

- In Amount and Received columns, the effect would be positive(+) for invoices, negative(-) for credits issued.

- At the end of the statement, total amount and total received are displayed.

- Total Amount: Sum of all the invoices less sum of all the credits given in the Amount column.

- Total Received: Sum of all the received invoices less sum of all the issued credits given in the Received column.

Below given a sample PDF format for Transaction Statement with explanation:

- We have selected date ranges from Mar 11, 2024 to Apr 30, 2024, for generating statements from the previous “Create Statement” modal. There are three transactions shown, as per specified selection.

- As you can see in the above PDF, we had not considered the balance forward amount.

- Hence, the first transaction is an invoice with an amount of 18,660, out of which total received amount is 18660, i.e. received full payment against this invoice. Then, an invoice with an amount of 1000, out of which only 50 is received by us and 950 is yet to be received from the customer. And lastly, credits issued of total 100, out of which 20 are given to the customer or adjusted against any outstanding invoices. i.e. 80 are remaining.

For more understanding of the transactions and its effects, please refer to the Transactions Tab within customer details.