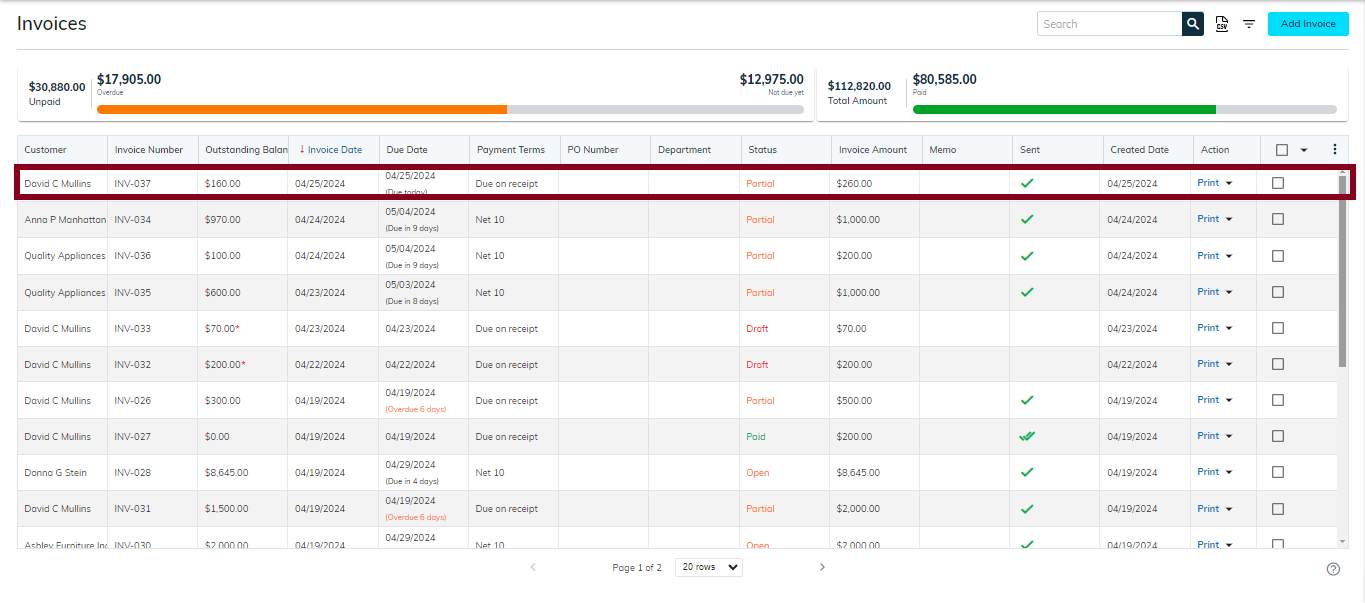

Invoice Detail

Invoice detail provides a comprehensive overview of each invoice, displaying essential information such as the customer name, invoice date, due date, total amount, status, and more. It offers a structured view to help users quickly identify and manage their invoices efficiently.

- To access a specific invoice information, click on that record, open the Invoice Detail modal

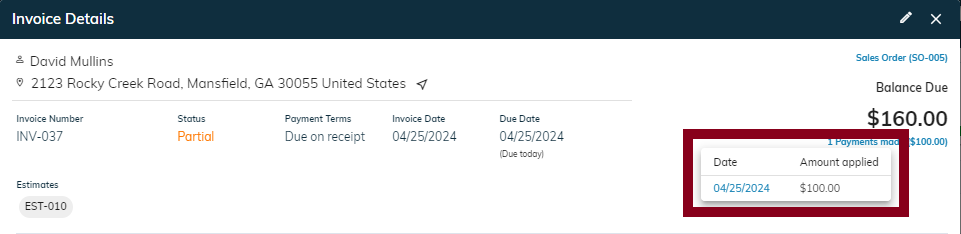

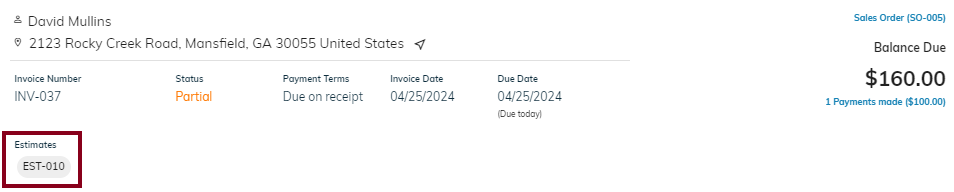

- For example: To access INV-037 information, click on the record.

- Below is the Invoice detail modal display.

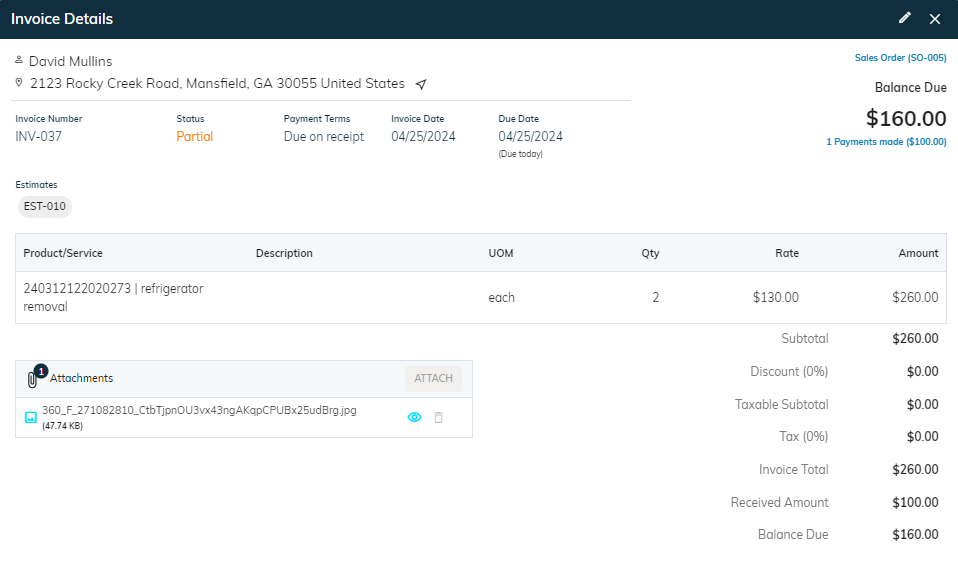

Edit Invoice

- Click on the “🖊️” (edit) icon in the upper left corner.

- Learn how to edit invoice details.

- After making necessary adjustments, then click Save to update the details.

Close Invoice detail

- Click on “X” to close the invoice details modal.

Invoice detail

- David Mullins is listed as the customer name on the invoice, indicating that the invoice is associated with his account.

- To access a specific customer information, click on that name, you will navigate to the Customer Detail screen.

- 2123 Rocky Creek Road, Mansfield, GA 30055, United States, is the address associated with the invoice.

- Click on this address to navigate to the location: 2123 Rocky Creek Road, Mansfield, GA 30055, United States.

- The Invoice number(INV-037) is a unique identifier assigned to each invoice for tracking and reference purposes.

- The Invoice date(04/25/2024) is the specific date when the invoice was created or issued to the customer.

- The Due date(04/25/2024) indicates the date by which the payment for the invoice should be received from the customer.

- Overdue days indicate the number of days that have passed since the payment of the invoice was due.

- Status : The status in an invoice indicates the current stage of the invoice processing. It could be "Draft," "Pending," "Paid," "Partial," or “Open” providing clarity on the payment status to both parties involved.

- Payment terms : Payment terms on an invoice specify the period within which the customer must pay the invoice.

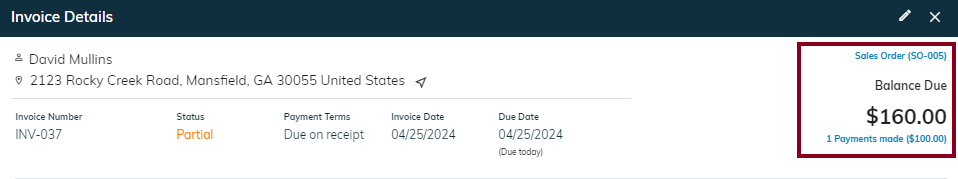

Refer interlined payment detail or sales order from invoice details

- sBizzl supports navigation and interaction. Enables users to interact with the displayed interlinked invoices or payment detail, such as clicking on a sales order code or payment detail to view its full details.

- Ensure seamless integration between the invoice and the sales order or payments detail module.

- If you have created a sales order from a specific invoice , then you can see the Sales Order navigation link along with code at the top right side of the detail dialog. (For instance: Sales Order (SO-005))

- Click on payment (1 Payments made ($100.00)) to view payment date information.

- The Payment Info modal presents details about the payment date and the amount applied, offering a clear snapshot of the payment status for the invoice.

- Similarly, for interlinking with payment, click on payment date to view linked payments details modal.

- Similarly, for interlinking with estimate, click on estimate code to view linked Estimate details.

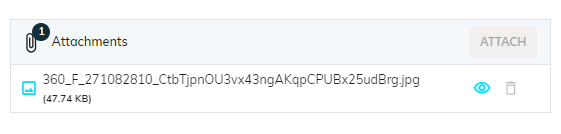

Attachments

- A dedicated section is included within the invoice details dialog for attachments.

- By implementing an attachments section in the invoice detail dialog, empowering users to enrich their invoice with additional documentation and visual assets, facilitating better communication and collaboration throughout the sales process.

- Provided with intuitive controls such as “Upload” button or drag-and-drop functionality, to allow users to add attachments to the invoice.

- Provide visual indicators such as thumbnails or file icons, to help users identify the type of attachment (e.g., PDF or image).

- Additionally, enable users to view or delete attachments associated with the invoice.

- Further, users can view the total uploaded file count and size.

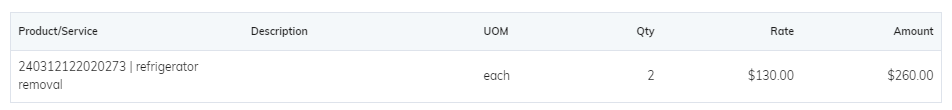

Products

The invoice product section showcases product details in a table format, listing product name, service type, unit of measurement (UOM), product description, quantity, rate, and total amount for each item.

- In the product and service section, each entry displays the product code along with the corresponding service provided.

- The description field provides detailed information about the product, highlighting its features, specifications, and any relevant details.

- UOM stands for "Unit of Measure," indicating the specific unit used to quantify a product or service.

- Product quantity refers to the number of units or items of a particular product included in the invoice.

- Product rate refers to the cost per unit or item of a particular product as listed in the invoice.

- Product amount is the total cost calculated by multiplying the quantity of a product by its rate.

- The message displayed on the invoice provides additional information or notes related to the invoice for the customer's understanding.

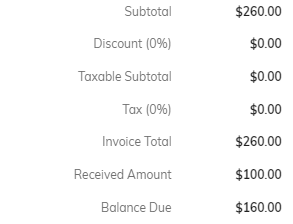

Invoice financial section

- The Subtotal is the total cost calculated before adding taxes, discounts, or additional charges to the invoice.

- The Discount refers to any reduction in the total invoiced amount, often applied as a percentage or fixed amount.

- The Taxable subtotal is the subtotal amount on which tax is calculated before applying any discounts or additional charge

- The Tax is the additional amount calculated based on the taxable subtotal, usually based on a specified tax rate.

- The Invoice total is the final amount to be charged, which includes the subtotal, any discounts, taxes, and additional charges if applicable.

- The Received amount in an invoice indicates the total amount that has been paid by the customer towards the invoice.

- The Balance due in an invoice is the outstanding amount that remains to be paid by the customer.