Understand tax and discount

When creating an estimate, invoice, credit memo, estimate template, invoice template, or recurring invoice template in sBizzl, you can include tax and discount for the order total. Learn more about how to apply tax and discount below.

- Discount Type: there are two types of discounts:

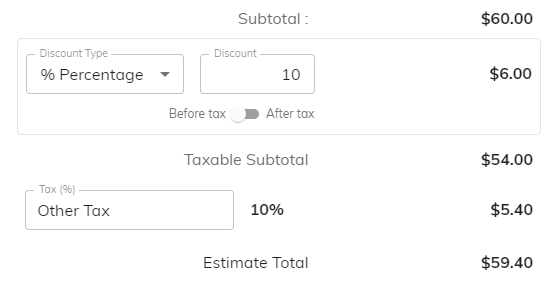

- Discount in Percentage: Users can apply a discount by entering a percentage. The system will automatically calculate the discount amount based on the subtotal and display it next to the subtotal.

- Discount in Amount: Users can apply a discount by entering an amount. It is displayed next to the subtotal.

- Discount After Tax: The system allows users to select a post-tax discount. This selection triggers an automatic recalculation of the final amount by the system.

- Taxable Subtotal: The system calculates the sum of all product amounts where the user selects the "Tax" ☑ checkbox in line items.

- Tax: Users can choose a tax rate by selecting it from a dropdown menu ▼. The selected percentage will be displayed alongside the chosen tax. The system will automatically calculate the tax amount based on the taxable subtotal and display it next to the taxable subtotal for clear reference.

- Total: This figure displays the final cost, reflecting the impact of any discounts or taxes that may have been applied.

- Balance Due: this field user can see only in invoice form. This value represents the outstanding balance on the invoice after applying for the customer's credit.